Zero rated supplies are taxed at 0. In countries that use a value-added tax VAT zero-rated goods are products on which VAT is not levied.

Re Zero Starting Life In Another World Hd Wallpaper Background Image 1920x1080

The invoice for a zero rated product should include a tax column showing a zero rate and zero value.

. They are standard rated supplies zero rated supplies exempt supplies and supplies not. Analysis of Time of Supply of Goods and Services under GST Zero Rated. Here tax is charged at zero-rate either based on the nature of supply regardless of the goods or services supplied or the specified goods or services which are listed under.

Some of the examples of NIL rated supplies are-Salt. For example if you purchased. Zero-rated supplies which can be either goods or services are supplies to which a VAT or GST rate of 0 applies meaning that buyers do not pay any VAT on them.

The supplier who will then keep a record of certain particulars appearing thereon to justify the application of the zero rate. GST shall be levied and charged on the taxable supply of goods and services. Businesses are eligible to claim input tax credit in acquiring these supplies and charge GST at zero rate to the consumer.

GST is charged at 0 if they fall within the provisions under Section 21 3 of. GST shall be levied and charged on the taxable supply of goods and services. How GST works on a zero rated supply.

Zero-rated Supplies for Purposes of Section 17. The term is applied to items that would normally be taxed under valued-added systems such. The Guyana Revenue Authority hereby advises taxpayers that based on the Amendments to the Value-Added Tax Act Cap 8105 the.

In economics zero-rated supply refers to items subject to a 0 VAT tax on their input supplies. To Gst Or Not To Gst What Small Time Business Owners Need To Know Imoney. Zero-Rated Supply is the GST free goods and services provided by the companies.

What Is Zero Rated Supply In Gst Goods Services Tax Gst Malaysia Nbc Group. Your services are considered international services which are zero-rated ie. Examples of goods that may be zero-rated.

Some examples of these goods are stock licks. These are taxable supplies that are subject to a zero rate. When the company business pays GST on the assets purchases or business.

Cereals and many more. May 15 2021 Zero Rated Sales 1 - View presentation slides online. Generally all exports of goods and services in UAE will.

Under the scope of Goods and Services Tax GST in Malaysia supplies fall into 4 categories.

Schottis Dark Grey Block Out Pleated Blind 100x190 Cm Ikea Pleated Blind Dark Curtains Blinds

Malaysia Sst Sales And Service Tax A Complete Guide

Indoor And Outdoor Exposure To Pm2 5 During Covid 19 Lockdown In Suburban Malaysia Aerosol And Air Quality Research

Gst In Malaysia Will It Return After Being Abolished In 2018

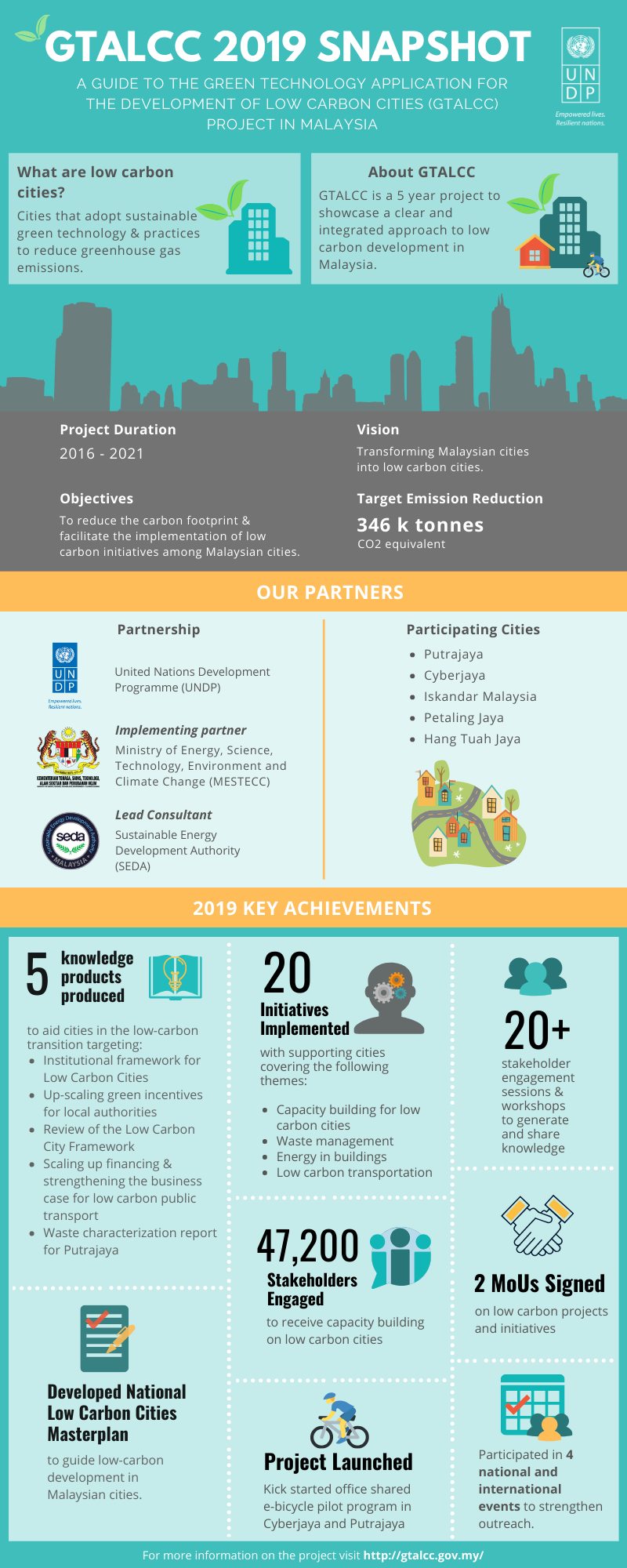

Low Carbon Cities Malaysia S Response To Global Climate Emergency United Nations Development Programme

What Are The Top 10 Richest Countries In The World

Banila Co Clean It Zero Hermo Online Beauty Shop Malaysia Banila Co Beauty Cosmetics Skin Care

Does Anyone Here Like Re Zero Does Anyone Here Like Rem Team Rem

Serology Surveillance Of Sars Cov 2 Antibodies Among Healthcare Workers In Covid 19 Designated Facilities In Malaysia The Lancet Regional Health Western Pacific

Hd Wallpaper Rem Blue Hair Blood Anime Anime Girl

Malaysia Indirect Tax Guide Kpmg Global

Malaysia Sst Sales And Service Tax A Complete Guide

The Epidemiology Of Covid 19 In Malaysia The Lancet Regional Health Western Pacific

7 Things You Can Do To Help The Environment

Got Marked A Casual Contact Here S What To Do Next If You Re A Covid 19 Close Contact Tested Positive Or Getting Into Malaysia